Managed SBLC Program

Managed SBLC Program (MSB)

MANAGED SBLC PROGRAM ROAD MAP

The Safe and Secure Method of Issuing & Monetizing a SBLC to create 5M, 15M or 75M of Non-Recourse Funding.

Quality Non Recourse Funding Solutions for Business, Real Estate, Investment & Projects Including…

Full Deposit Protection by an Independent Trustee

Three Program Options

Option 1: $750K USD to 3M

Option 2: $1.5M USD to 15M

Option 3: $3M USD to 75M

Completion Time 2 Months (approx)

The Managed SBLC Program is Managed by:

Email: contact@aramcocapitaltrading.com

Web Site: https://www.armcapitaltrading.com/

Partnering for Success

Independent Trustee Protection

The Biggest Issue for Most Investors is Protecting their Deposit and avoiding being Scammed.

We have achieved Full Protection of Investors Deposits by ensuring that all investors pay their Deposit funds to an Independent Trustee who protects and holds the investors funds safely in Trust.

Funds are NOT released by the Independent Trustee to the SBLC Issuer until the Issuers Bank has successfully delivered the SBLCs MT799 to the Monetizing Bank and the Independent Trustee has verified that the Receiving Bank has received, authenticated and verified the authenticity of the SBLC asset. Only when the SBLC’s MT799 has been authenticated are investors funds released by the Trustee for the SBLC Issuer to complete the transaction by delivering the SBLC’s MT760 to the Receiving Bank.

Investors Funds are totally protected by the Independent Trustee because if for ANY REASON the Issuing Bank DOES NOT Successfully complete the delivery of an authentic MT799 to the Receiving Bank then the Independent Trustee will within 10 days of confirming this return the Investors Deposit Funds back to the Investors Bank Account.

Using this method, we are able to protect investors funds and ensure we only close and complete genuine, legitimate funding transactions.

The Independent Trustee is a seasoned Financial Instruments Expert who works and lives in one of the Worlds Largest Financial Centers. He has years of experience completing successful financial transactions and does not work for either the SBLC Issuer or the SBLC Monetizer.

The Independent Trustee is available for in person face to face meetings with investors as well as being contactable by phone, email and skype.

The Independent Trustee signs the Managed SBLC Program Agreement along with the Investor and the SBLC Issuer and all parties provide full and detailed disclosure of their addresses, passports and detailed contact information. Nothing is hidden so the entire process is completely transparent.

6 Reasons People Fail with Financial Instruments

Here are the 6 Reasons why many people Lose Money or Waste Large amounts of Time in the Financial Instruments market Without achieving Success:

People are lured in by fake artificially low prices of financial instruments offered by scammers. When a scammer isn’t delivering anything real they can afford to offer you the deal of the century! Price Shopping clients will always get a bargain that will cost them a fortune. Read More: Click Here.

People get blinded by Greed and the possibility of becoming an Instant Millionaire, so they stop thinking Rationally and Clearly. They stop being careful and start being careless which causes them to not see all the obvious warning signs that lead right to a scammer’s front door

People that have never closed a real transaction before create a complex set of financial instrument procedures and then engage 55 brokers to trawl the internet as a their speed dating service trying to find another party to match their procedure. This is the playbook of an amateur who has as much chance of winning the lottery as he does changing the whole financial instruments industry to solely work with his isolated ill-conceived procedure.

Some fool started a false rumor 10 years ago telling people they could buy financial instruments with no cost, no upfront fees, no money needed at all. This fairytale has become so famous now thousands of people mistakenly believe it! Banks have NEVER sent multimillion dollar assets to customers for FREE and then hope the customer pays them later. This would be financial lunacy! We have offered a reward for years to ANY customer that can show us evidence they made millions from completing a no upfront fee deal. Not 1 person has ever claimed the reward!Don’t believe in fairytales. Read More: Click Here.

Most Unrated Bank Instruments are cheap because they aren’t worth the paper they are written on! Any one can buy a banking license from an offshore country for $9,000 USD and call themselves a bank. There is a reason Unrated Banks charge $25,000 USD for a 100 Million Financial Instrument! They know it’s not worth $25,000! You can’t buy crap and get rich, you have to buy quality financial instruments from Rated Banks. Read More: Click Here.

- People mistakenly think Banks sell Financial Instruments, they DON’T! The Bank is a Post Office that acts on instructions from one of the Bank Account Holders to write a financial instrument against the Account Holders Bank Account and deliver it to a client. Account holders sell instruments, banks just deliver them! There are many ignorant people in the industry demanding to solely purchase a financial instrument from the bank!That will NEVER happen because the bank doesn’t sell them, they just deliver them!If you don’t deal with the Account Holder, you will NEVER buy a financial instrument. More Info: Click Here.

Aramco Capital Trading has designed this Managed SBLC Program to help you avoid the above mistakes and to help you achieve a safe successful authentic funding solution.

Bank Consultants NOT Brokers!

Aramco Capital Trading is a group of experienced ex Bankers and Finance Experts that are direct to the signatories of the Managed SBLC Program.

Our Team is highly respected and extremely knowledgeable because members of our Executive were Bankers that worked in Trade department of Top 50 Bank, Financial Instrument Departments themselves. It is our unique expertise and contacts that have made the Managed SBLC Program a reality!

We have direct communication and face time with Senior Bank Leaders, Key Decision Makers and Signatories enabling us to close deals and get results that other companies cannot.

Time Completion Guide

Time | Description |

1 Day | – Client Compliance Application |

1 Day | – Audit |

1 Day | – Corrections |

1 Day | – Re-Audit (If Required) |

2 Days | – Compliance |

3 Days | – Agreement |

2 Days | – Independent Trustee Call |

10 Days | – Independent Trustee Meeting (If Required) |

2 Days | – Deposit Paid |

30 Days | – Program |

30 Days | – Funding |

Note: Times are estimates only and are subject to change. Days given are banking days.

Deal Completion Roadmap

Stage 1 | Client Compliance Application |

All clients are required to complete the Aramco Capital Trading Managed SBLC Client Compliance Application which provides Full Details from the Client as well as Proof of Funds and Important Required Banking Disclosures. | |

Stage 2 | Audit |

Our Legal Department Audits the Client Compliance Application for missing information, inconsistent data, mistakes and incongruent information. | |

Stage 3 | Corrections (If Required) |

(If Required) The Client Compliance Application is returned to the client by our Legal Department and the client is asked to make the necessary corrections, changes or provide additional information as required. | |

Stage 4 | Re-Audit |

Our Legal Department Audits the Client Compliance Application for missing information, inconsistent data, mistakes and incongruent information. Once the Application Passes Audit it moves to Compliance. | |

Stage 5 | Compliance |

Our Compliance Team Reviews the Client Compliance Application to check the authenticity of the information provided, the good standing of the Applicant and that the funds earned by the client will not be used for an illegal activity such as drugs, guns or money laundering. | |

Stage 6 | Agreement |

Our Legal Team then issues a Comprehensive Managed SBLC Agreement (26 Page) that provides full details of the Independent Trustee, SBLC Provider, Protections of the clients Deposit and time lines for the completion of the transaction. | |

Stage 7 | Independent Trustee Call |

We schedule a Phone, Skype or Skype Video Call (the Client chooses his preference) between the Client and the Independent Trustee where the client can ask as many questions as he desires. | |

Stage 8 | Independent Trustee Meeting (If Required) |

(If Required by the Client) We will schedule a Physical Face to Face Meeting between the Client and the Independent Trustee in the Independent Trustees offices. | |

Stage 9 | Deposit Paid |

The Client then pays the Deposit and any fees to start the program. | |

Stage 10 | Program |

The 8 Step Managed SBLC Program commences as follows:

| |

Stage 11 | Funding |

Funding is paid in 3 Payments.

|

Managed SBLC Program Advantages

- Program operated with SBLC from – Top 50 World Banks

- Funding is normally completed in 2 Months

- Straight Pre-negotiated SBLC Buy / Sell

- Full Non Recourse Funding Provided. No Repayments Required

- No Interest Charged

- No Equity Percentage Required

- No Security Needed apart from the Deposit

- No Personal or Corporate Credit Checks

- No Project Documentation Required

- Up to 2% Commission Paid to Brokers

- Program Contract normally provided within 72 Hours of our Compliance Departments Approval

Managed SBLC Program Explained

with Deposit Protection by Independent Trustee

This is a Professional Funding Program that is used by many businesses and individuals to create funds for Real Estate projects, Business Acquisitions and Expansion, Entertainment Finance, and Investing.

The Managed SBLC Program delivers Non Recourse Funds which do not need to be repaid and have no interest attached. As a result this process is a favoured wholesale funding source for Angel Investors, Equity Partners, Private Equity Firms and Business Loan Providers.

The Program has 3 Entry Levels:

- $750,000 USD Deposits creates 5 Million USD in Funding

- $1,500,000 USD Deposit creates 15 Million USD in Funding

- $3,000,000 USD Deposit creates 75 Million USD in Funding

Clients can choose to enter the Program at any one of these 3 Levels. And the Program can be repeated as many as 6 times per client per year.

The Program is safe, secure and utilizes proven providers that have a history of performance, completion and delivery. Clients Deposit funds are protected by an Independent Trustee who only releases the Clients Deposit funds we he has confirmed with BOTH the Issuing and Funding Bank that the transaction and Funding are unconditional.

The Managed SBLC Program oversees and coordinates the Purchase of a Leased SBLC (Standby Letter of Credit) from a World Top 50 Bank and then arranges for the SBLC to be delivered to the Funding Bank to create a Non Recourse monies that are then paid directly to the client.

The Managed SBLC Process uses this 11 Step Plan:

- SBLC is Ordered with the Bank

- SBLC is Created

- Issuing Banks Sends MT799

- Receiving Bank Verifies and Authenticates the MT799

- Receiving Bank Replies to MT799

- Issuing Bank receives Receiving Banks MT799

- Issuing Bank Send MT760

- Receiving Bank Verifies and Authenticates the MT760

- First Non-Recourse Payment is Completed

- Second Non-Recourse Payment is Completed

- Third Non-Recourse Payment is Completed

This entire process is completed seamlessly using our proprietary technology and funding system.

Nett Funding Returns & Costs

The Managed SBLC Program pays clients a Nett Return of 5, 15, or 75 Million Dollars depending on the Program level they have selected to participate on. Payments to clients are inclusive of all program costs and the only deductions that are made from the clients final Funding Payments are:

a) Broker Commissions of 1.5%

b) Paymaster Costs of between .5% and 1%

Transparency & Full Disclosure

We provide full disclosure of all parties, including BOTH the Independent Trustee and the SBLC Issuer with their company details, passports, names, address, email and phone numbers in the Managed SBLC Agreements which each client receives AFTER clients have submitted their completed Managed SBLC Program Application Form to Aramco Capital Trading and AFTER our Compliance Department has vetted and approved the Client’s Application. We operate a genuine, real and fully transparent system.

Understanding The Funding Mechanics

The power of the Managed SBLC Program is in its simplicity and the way in which Aramco Capital Trading has pre-structured and pre-negotiated the outcome for clients.

The Managed SBLC Program purchases a SBLC from a Top 50 World Bank at predetermined price and delivers that SBLC to a highly reputable and proven monetizer (funder) who pays a higher price for that Standby Letter of Credit. This results in a profit margin (the gap between the buying price and the selling price) which is then shared between us and the Client …. YOU!

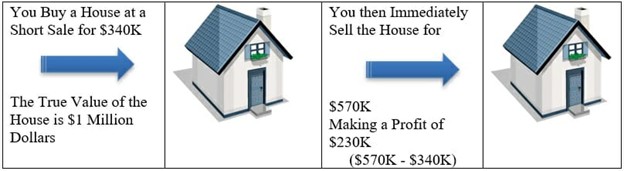

This same process happens in Real Estate all the time….

The net result in the above Real Estate Transaction is a Profit of $230,000, which you are not required to repay to anyone.

All Parties in the real estate transaction benefited: The Short Sale Property Sold, the Buyer who bought the 1 Million Dollar Property from you at $570K is happy, and you walk away with a $230,000 Cash Profit to use however you like.

The SBLC Transaction follows exactly the same process. But instead using a House as the asset, we use a Top 50 World Bank Security Certificate called a Standby Letter of Credit.

The Complete Managed SBLC Program utilizes a Standby Letter of Credit that is issued by a respected Top 50 World Bank because of the underlying financial strengths of that organization and the fact that are:

- Highly Respected

- Safe

- Valuable

- Internationally Recognized

- Financially Stable

- Long Term Expertise in SBLCs

The Standby Letter of Credit we use for this program have been Pre-Approved by our Funder for prompt and efficient payout after Delivery, Authentication and Verification.

This enables us to consistently operate the program because we are using Tested, Proven, Highly Credible and Well-Established service providers to both issue and monetize the Standby Letter of Credit.

7 Ways You Are Protected!

The Managed SBLC Program provides Clients with a Number of Important Protections, including:

1. Client Deposits are 100% Capital Protected by an Independent Trustee.

2. Clients don’t pay 1 cent anywhere until ALL Parties (Client and Independent Trustee and the SBLC Provider) have signed the Managed SBLC Program Agreement.

3. The Managed SBLC Program is completed using a highly recognized commercial financial instrument called a “Standby Letter of Credit” that is issued and cash backed by a World Top 50 Bank. The transaction therefore uses a financial instrument with a real value to create a real result.

4. The Program has pre-negotiated and pre-structured the terms of buy and sell price of the SBLC BEFORE we buy it; this completely minimizes the risk because the transaction is pre-structured and pre-agreed with a buyer BEFORE the SBLC is even purchased.

5. The SBLC delivery and settlement process is a bank-to-bank transaction, which is completed on the Bank SWIFT Network. It is therefore very secure and a number of detailed bank procedures need to be followed giving protection to all parties.

6. Standby Letter of Credits, SBLCs and other financial instruments have been operating in the banking industry for a very long time and are well known and recognized.

7. The service providers in the Managed SBLC Program make their money from completed deals not from client deposits which are a faction of the profits from an accomplished transaction.

Top 6 Reasons Why Aramco capital Trading is #1

1. An Aramco Trading Company.

2. Funded by Oil Rich Saudis

3. Your Privacy is our Priority.

4. Our Integrity is Non Negotiable!

5. We are the Provider for up to 99% of Deals in the market

6. We Operate our own Private Placement Program & Account Management Systems.

The Managed SBLC Program does NOT involve currency trading fluctuations, stock market movements, Bitcoin or any other High Risk Investments.

Why the Deposit is Essential!

ALL Clients who wish to participate in this program MUST make either a $750k, $1.M or $3M Deposit.

No Deposit, No Program Participation!

The Deposit is required for 4 Reasons:

1/ World Top 50 Banks will NOT issue a SBLC unless they have an assurance that when they complete delivery of the SBLC to the funder that they will be promptly paid for creating and delivering the Standby Letter of Credit.

2/ ALMOST ALL banks now require Clients to make a good faith payment at the start of a SBLC transaction. Too many Banks have been burned with failed SBLC transactions by clients who have refused to show any capacity to be able to:

- a) Either make a good faith payment, or

b) Settle a legitimate SBLC transaction.

The high rate of failed SBLC transactions from clients who have not invested any money in the settlement of their own SBLC transactions has lead most Banks and SBLC Issuers to now require good faith payments BEFORE a SBLC is Issued by a bank.

3/ If clients could get $75 Million or $200 Million Dollar Standby Letter of Credits issued without contributing a single dollar, every homeless person on the planet would be doing it! There has to be a common sense barrier to prohibit that sort of foolishness and misuse. Obtaining a SBLC without providing any kind of Deposit is a Fairy Tale. Read more about why FREE Financial Instruments don’t exist here.

4/ There has been a high level of fraud with Proof of Funds and Bank Statements. Ice Invest Capital Trading’s view is if a client cannot transfer the required Deposit of $360k, $450K or $600K to an Independent Trustee (after all program documents are signed by all parties) when they “claim” to have funds to buy a $20 Million Dollar Standby Letter of Credit, then the client probably is NOT real and Aramco Capital Trading shouldn’t be doing business with them.

Brokers & Consultants 100% Protected

We value and appreciate the role Brokers & Consultants play in facilitating client transactions. Here are the Aramco Capital Trading commitments to Brokers & Consultants….

- Brokers are Always 100% Protected & Respected

- Healthy Commissions Paid on every Deal

- Be Direct to the Finance Source, NOT in a Broker Chain!

- Earn up to 1.5% Commission on Every Deal

- Professional Broker Support

- Wide Range of Financial Instrument, PPP and Funding Client Services

- Master Country Broker Licensing available.

- We offer 3 Profitable Broker Levels:

Click here now and Register as a Aramco Capital Trading Broker.

Questions and Answers: Managed SBLC Program

No. The Independent Trustee we utilize is a seasoned expert in the Financial Instruments industry with a proven track record of successful transactions alongside the SBLC Issuer and SBLC Funder. This Trustee’s deep understanding of the financial instruments market allows them to swiftly address and resolve any issues or, if necessary, facilitate a refund of your deposit. This level of expertise and trust cannot be guaranteed with other trustees or escrow services.

Yes, this is acceptable. However, it is mandatory that ALL funds must be clean, clear, and of non-criminal origin. Proper documentation and verification will be required to comply with financial regulations.

We are dedicated to serving serious clients who have completed and submitted the Managed SBLC Program Enrollment Form. Once you provide the required documentation, we will gladly allocate one of our experts to address all your inquiries in detail. This ensures that our time and resources are focused on genuine opportunities.

For further assistance, contact Aramco Capital Trading to begin the enrollment process and gain access to our experts for personalized guidance. Secure your spot in the Managed SBLC Program today!

IMPORTANT: WE RECOMMEND ALL CLIENTS TAKE LEGAL AND ACCOUNTING ADVICE PRIOR TO COMPLETING ANY SBLC TRANSACTION.

Program Investment Options & Returns

Participation in the Managed SBLC Program is available to approved clients on one of the following three options:

A. Option 1: Minimum of $750,000 USD Deposit / Returns $3 Million Non Recourse

B. Option 2: Minimum of $1,500,000 USD Deposit / Returns $15 Million Non Recourse

C. Option 3: Minimum of $3,000,000 USD Deposit / Returns $75 Million Non Recourse

Note: Prices in USD

Managed SBLC Program Fees Breakdown

Your investment in this Program contributes to paying all the following costs which are essential for the success of the Managed SBLC Program:

- Client Audit & Due Diligence

- Risk Analysis&Mitigation

- Legal Preparation of Managed SBLC Agreement

- Legal Review of Transaction Structure

- Legal Review of Providers & Bank Documentation

- Minutes, Resolutions and Shareholder Approvals

- Non Recourse Funds Structuring

- Independent Trustee Fees

- Transaction Management and Oversight

- Payment of MT799 Swift Charges

- Payment of MT760 Swift Charges

- SBLC Verification, Authentication & Validation

- Accounting Systems and Audit

- Establishing Client Transaction Account

- Payment Processing of Clients Funds

- Payment Processing of Broker Payments

- Paymaster Integration, Agreements and Consultation

- Transaction Settlement Report

Clients may Repeat the Managed SBLC Program up to 6 Times per Year.

How to Get Started!

Step 1: Request the Managed SBLC Program Client Compliance Application Form.

Contact us here for more information

Step 2: Complete the Managed SBLC Program Client Compliance Application and send it to:contact@aramcocapitaltrading.com

With Years of Finance Trading and Oil Industry Experience, Aramco Trading Executive Team understands the Banking Industry from the Trading Perspective, because members of our Executive worked in the Financial Instruments Department of a World Top 100 Bank. We can Achieve Results others can’t because we understand from the Inside, what it takes to close a deal from the Outside!